Simple. Portfolio. Monitoring.

By Investors. For Investors

Get Started For Free

Risk Analysis For A New Regime

The market has experienced a regime change in the risk factors that matter. Traditional factors don't account for the increasing impact other market participants, such as passives and other investor-types, have had on positions and portfolios. Symmetric.io provides risk aggregation across portfolios and extends it beyond traditional factors to understand interdependencies and interaction with other market participants.

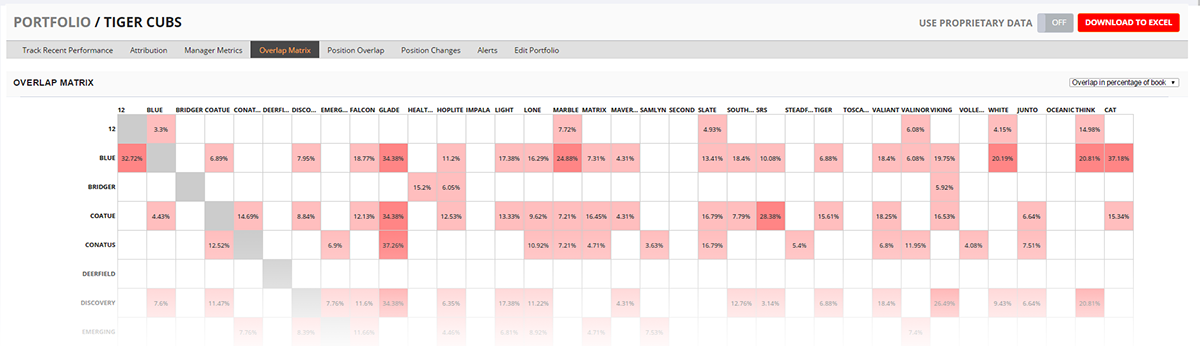

Holder Based Factor Decomposition

Symmetric has pioneered a number of holder based factors that help investors better understand their exposure to other market participants involved in a security:

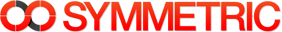

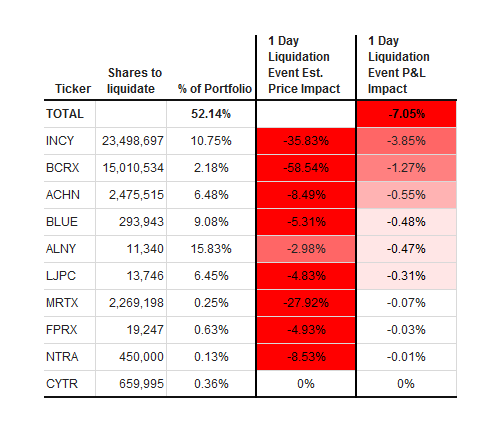

Overlap and Liquidation Risk

Symmetric overlap reports help investors understand:

Reporting

Generate PDF & Excel reports covering performance, alpha, liquidity, and peer analysis. Reports are updated daily to reflect current market conditions. A sample of reports:

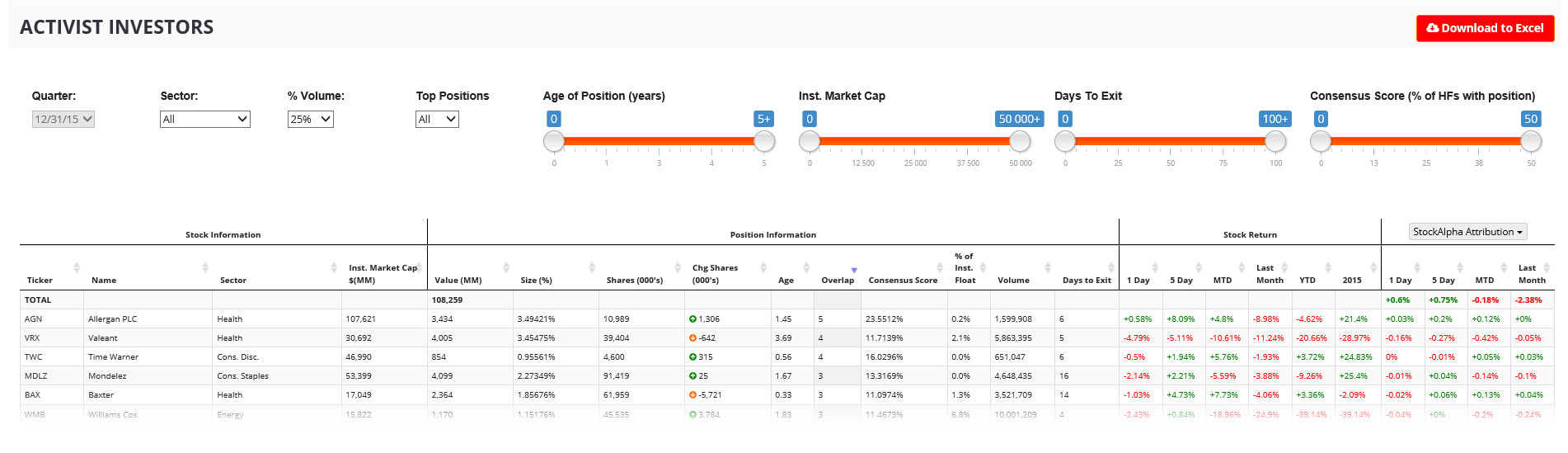

Portfolio Aggregation

Build & monitor portfolios of equities based on separately managed accounts, hedge funds, etc. Upload custom portfolios -- just copy and paste from Excel. Track the performance of individual portfolios and aggregate portfolios of managers daily according to their disclosed positions and contribution from StockAlpha -- the ability to pick stocks that outperform their corresponding sectors on a beta-adjusted basis.

Transparent Pricing

- Research Managers

- Manager Descriptions, Key Principals, & Place of Business

- Manager Holdings & Allocations

- Investments Reports

- Quarterly Symmetric Top Managers Rankings

- Symmetric News

- Everything in Registered +

- Monitor Hedge Fund Managers

- Real Time Performance & StockAlpha Monitoring

- Position-level Performance Attribution & Overlap Analysis

- Excel Download of positions & manager-metrics

- Performance & Key Mover Alerts

- Research Hedge Fund Managers

- Drilldowns on StockAlpha, SizingAlpha, SectorAlpha, Absolute Return Estimates

- Analysis of Winning / Losing Trades

- Consensus Analysis of Individual Manager Portfolios and Positions

- Turnover, Liquidity, Concentration Drilldowns

- Up to twenty PDF Reports on Hedge Fund Managers

- Screen & Compare Hedge Fund Managers

- Sector Allocation, Turnover

- Alpha & Return metrics, Sharpe Ratio

- Hit Rate, Win Ratio, Slugging Percentage

- Analyze & Benchmark Returns

- Upload Net Return Data

- Run Alpha, Beta, Drawdown analysis against Symmetric.io & market benchmarks

- Everything in Pro +

- Crowded Trades Analysis

- Assess Hedge Fund Crowding of Individual Manager Portfolios and Positions

- Upload private portfolios

- Calculate the exposure to crowding and identify the key drivers of crowding in your portfolio

- Access the Symmetric Research Team